Now that I have this basis statement what do I do with it?

Part 5 of the Shareholder’s Basis Statement lists the items that need special handling when you prepare your Form 1040 Individual Tax Return

Taxable distribution in excess of stock basis:

When your distributions exceed stock basis, the excess is taxable as capital gains. If you have held your stock in the S corporation for more than one year, then this is taxable at long-term capital gains rates, otherwise it is taxed at the ordinary income tax rates.

Use Form 8949 to include the income from the excess distribution income on your return.

To report short-term amounts, use Part I and check box “C” Short-term transactions not reported to you on Form 1099-B. On line 1, column (a), Description of property, enter the name of the company followed by “excess distribution”. In column (b) enter the date you purchased your shares in the S corporation, or the incorporation date. Enter the end of the tax year column (c). In column (d), Proceeds, enter the amount of the taxable distributions in excess of stock basis as shown on your basis statement. The values for Columns (e) and (g) should be $0 and the gain or loss reported in Column (h), which should be the same as Column (d).

To report long-term amount, use Part II and check box “F” Long-term transactions not reported to you on Form 1099-B. Report the amount in a similar fashion as described for short-term transactions but using Part II.

Follow the instructions Schedule D to transfer the values from Form 8949 to Schedule D.

Taxable loan repayments in excess of debt basis:

If you receive repayments for loans with reduced debt basis, some or all of the repayments will be taxable since the debt basis was used to absorb losses in prior years.

If the loans were memorialized with a written note, the repayments are subject long-term capital gains taxes. Otherwise their repayments are taxed at short-term rates.

To report short-term amount, use Form 4979, Part II, Ordinary Gains and Losses. In Column (a), Description of property, enter the name of the company followed by “taxable loan repayment”. In column (b), enter the date of the loan, or the beginning of the tax year. In column (c) enter the date of the repayment. In column (d) enter the amount of taxable loan repayments as reported on your basis statement. Columns (e) and (f) should be $0 leaving the gain reported in column (g) the value reported in Column (d).

To report long-term amounts, use Form 8949, Part II and check box “F” Long-term transactions not reported to you on Form 1099-B. On line 1, column (a), Description of property, enter the name of the company followed by “taxable loan repayment”. In column (b) enter the date you purchased your shares in the S corporation, or the incorporation date. Enter the end of the tax year column (c). In column (d), Proceeds, enter the amount of the taxable loan repayments in excess of debt basis as shown on your basis statement. The values for Columns (e) and (g) should be $0 and the gain or loss reported in Column (h), which should be the same as Column (d).

Follow the instructions Schedule 1, Line 14 to transfer the values from Form 4797 to Schedule 1. Follow the instructions Schedule D to transfer the values from Form 8949 to Schedule D.

Nondeductible expenses carried over to next year:

Unless you’ve made the election for Special Ordering rules per Treas. Reg. § 1.1367-1(g), this amount should be $0.00. If you have made the election, you will need the value to correctly calculate your basis for next year. Add the nondeductible expenses carried over to the nondeductible expense reported on next year’s Schedule K-1 as part of your next year’s basis calculation.

Suspended losses carried over to next year:

If your losses exceed your stock and debt basis, you will have suspended losses. Allowed losses are allocated proportionally over all losses reported on your Schedule K-1. You will need to adjust the amount of any loss item reported on your Schedule K-1 when you are preparing your individual tax return. Attach a copy of your basis calculation statement with your return.

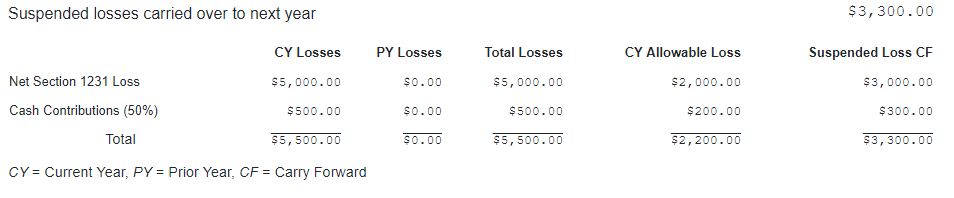

Use the amounts in the “CY Allowed Loss” to report the losses up to your basis. In the example below, to include the correct amount of income on your individual return, you would need to enter ($2000.00) loss for Boxes 9, Net §1231 Loss and $200 in box 12A for Cash Charitable contributions when reporting the values of your Schedule K-1. The $3300 suspended would be added to next year’s values.

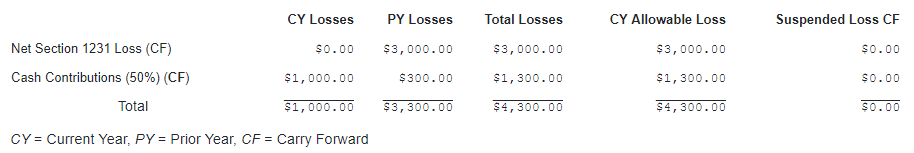

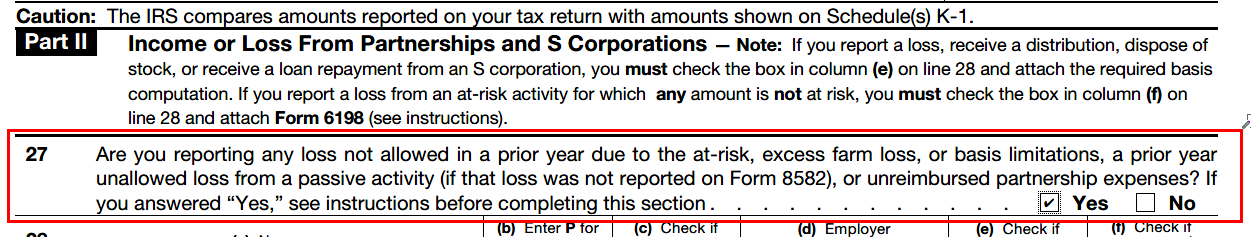

Assuming you have sufficient increases to basis in the subsequent year, you can deduct the suspended losses. Report the fact that you have suspended losses on the Schedule E, Part II, Line 27 checkbox. Enter the prior year losses on Line 28 on a separate row directly under the values for the current year. Enter “PYA” (Prior Year Amounts) in the name column. Do not combine the prior year losses with the current year amounts. Be sure to attach a copy of your basis calculation with your return.

How to attach PDF basis statement to your e-filed return:

Some consumer tax software allows you to attach a PDF statement to your return, but unfortunately most do not. If you cannot attach the PDF copy of your basis statement to your return, you will need to paper file the return.

Below are links to the support sites of the more popular consumer tax softwares with instructions on how to attach a PDF or print the return for paper filing. The printed copy of the return from your software should be in the correct sequence for IRS processing. Add the basis statement after all the forms and schedules included in your return. Be sure to keep a copy of the return and your basis statement for your records.

Tax Act:

TurboTax:

It appears as though TurboTax does not currently support attaching PDF files to an e-file return. Unfortunately, you will need to paper file your return if a basis statement is required. Here are instructions for printing your return for paper filing:

- TurboTax Online: https://ttlc.intuit.com/questions/1944348-how-do-i-print-and-mail-my-return-in-turbotax-online

- TurboTax PC: https://ttlc.intuit.com/questions/1914216-how-do-i-print-a-copy-of-my-return-filed-in-the-turbotax-cd-download-software

- TurboTax Mac: https://ttlc.intuit.com/questions/1944096-how-do-i-paper-file-in-the-turbotax-for-mac-cd-download-software

H&R Block:

It appears as though H&R Block Tax Software does not currently support attaching PDF files to an e-file return. Unfortunately, you will need to paper file your return if a basis statement is required. Here are instructions for printing your return for paper filing:

- H&R BLock Online: https://www.hrblock.com/tax-center/support/online/technical-issues-online/printing-tax-returns/

- H&R Block Tax Software: https://www.hrblock.com/support/software-support.html

Tax Slayer:

You can print your return through the Summary/Print tab on the navigation bar sign, and mail the return for filing.